How Social Security benefits are taxed depends on your other income. In the worst case scenario, 85% of your benefits would be taxed. (This doesn’t mean you pay 85% of your benefits back to the government in taxes—merely that you would include 85% of them in your income subject to your regular tax rates.)

To determine how much of your benefits are taxed, you must first determine your other income, including, for this purpose, tax-exempt interest. Add to that the income of your spouse, if you file jointly. To this add half of the Social Security benefits you and your spouse received during the year. The figure you come up with is your total income plus half of your benefits. Now apply the following rules:

1. If your income plus half your benefits is not above $32,000 [$25,000 for single taxpayers], none of your benefits are taxed.

2. If your income plus half your benefits exceeds $32,000 but is below $44,000, you will be taxed on (1) one half of the excess over $32,000, or (2) one half of the benefits, whichever is lower.

Example (1): Sam and Denise have $20,000 in taxable dividends, $2,400 of tax-exempt interest, and combined Social Security benefits of $21,000. Thus, their income plus half their benefits is $32,900 ($20,000 plus $2,400 plus 1/2 of $21,000). They must include $450 of the benefits in gross income (1/2 ($32,900 − $32,000)). (If their combined Social Security benefits were $5,000, and their income plus half their benefits were $40,000, they would include $2,500 of the benefits in income: 1/2 ($40,000 − $32,000) equals $4,000, but 1/2 the $5,000 of benefits ($2,500) is lower, and the lower figure is used.)

[For single taxpayers substitute the following for the above:2. If your income plus half your benefits exceeds $25,000 but is below $34,000, you will be taxed on (1) one half of the excess over $25,000, or (2) one half of the benefits, whichever is lower.

Example (1A): Sam has $20,000 in taxable dividends, $2,400 of tax-exempt interest, and Social Security benefits of $9,000. Thus, his income plus half his benefits is $26,900 ($20,000 plus $2,400 plus 1/2 of $9,000). He must include $950 of the benefits in gross income (1/2 ($26,900 − $25,000)). (If his Social Security benefits were $3,000, and his income plus half his benefits were $30,000, he would include $1,500 of the benefits in income: 1/2 ($30,000 − $25,000) equals $2,500, but 1/2 the $3,000 of benefits ($1,500) is lower, and the lower figure is used.)]

3. If your income plus half your benefits exceeds $44,000 [$34,000 for single taxpayers], the computation in many cases grows far more complex. Generally, however, unless your income plus half your benefits is fairly close to $44,000 [$34,000 for single taxpayers], if you fall into this category, 85% of your Social Security benefits will be taxed.

Caution: Since the higher your income the more of your Social Security benefits that are taxed, an unplanned increase in your income can have a double tax cost. You’ll have to pay tax (of course) on the additional income, but you’ll also have to pay tax on more of your Social Security benefits. And you may get pushed into a higher marginal tax bracket. This situation might arise, for example, when you receive a large distribution from a retirement plan during the year.

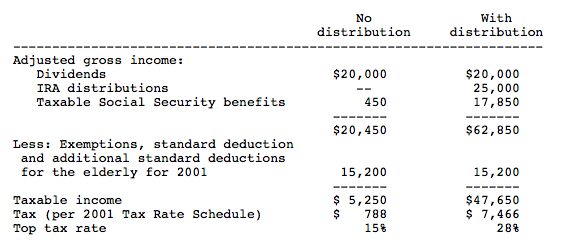

Example (2): Assume the same facts as in Example (1), above, for 2001, except that towards the end of the year Sam and Denise pull $25,000 out of their IRA, in order to give their son cash for a down payment on a new home. The IRA withdrawal adds $25,000 to their income. Taking into account only this $25,000 of additional income, they would still be in the 15% tax bracket. So they would expect to pay $3,750 additional tax (15% × $25,000). However, in this scenario, under the rule at 3 above, 85% of their combined Social Security benefits ($17,850, i.e., combined Social Security benefits of $21,000 × 85%) is now taxable, because their total income plus half their combined Social Security benefits is $57,900 (that is, $20,000 in taxable dividends, plus the $25,000 IRA distribution, plus the $2,400 of tax-exempt interest, plus one-half of the $21,000 Social Security benefits, or $10,500), which exceeds $44,000. As a result, their total taxable income is increased not only by the $25,000 IRA distribution itself, but by an additional $17,400—the amount of the increase in their taxable Social Security benefits ($17,850 − $450 [the amount of their taxable Social Security benefits if there hadn’t been an IRA distribution, see Example (1) above]). In addition, Sam and Denise are now pushed into the 28% marginal tax bracket. So their total tax increases by $6,678 ($7,466 − $788, see calculation below). (Looked at another way, their IRA distribution is in effect being taxed at a 28% rate.) Here’s how the tax is affected by the distribution: No distribution With distribution Adjusted gross income: Dividends $20,000 $20,000 IRA distributions — 25,000 Taxable Social Security benefits 450 17,850 $20,450 $62,850 Less: Exemptions, standard deduction and additional standard deductions for the elderly for 2001 15,200 15,200 Taxable income $5,250 $47,650 Tax (per 2001 Tax Rate Schedule) $788 $7,466 Top tax rate 15% 28%

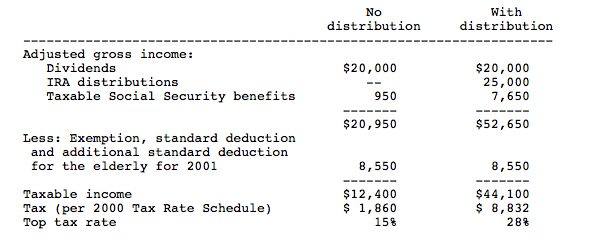

Example 2A: Assume the same facts as in the above example for 2001, except that towards the end of the year Sam pulls $25,000 out of his IRA in order to give his son cash for a down payment on a new home. The IRA distribution adds $25,000 to Sam’s income. However, under th

e rule at 3 above, 85% of Sam’s Social Security benefits ($7,650, i.e., Social Security benefits of $9,000 × 85%) is now taxable, because his total income plus half his Social Security benefits is $51,900 (that is, $20,000 in taxable dividends, plus the $25,000 IRA distribution, plus the $2,400 of tax-exempt interest, plus one-half of the $9,000 Social Security benefits, or $4,500), which exceeds $34,000. As a result, Sam’s total taxable income is increased not only by the $25,000 IRA distribution itself, but by an additional $6,700—the amount of the increase in his taxable Social Security benefits ($7,650 − $950 [the amount of Sam’s taxable Social Security benefits if there hadn’t been an IRA distribution, see Example (1A) above]). And so Sam’s total tax increases by $6,972 ($8,832 – $1,860, see calculation below). (Looked at

another way, Sam’s distribution is in effect being taxed at an almost 29% rate.) Here’s how the tax is affected by the distribution: No distribution With distribution Adjusted gross income: Dividends $20,000 $20,000 IRA distributions — 25,000 Taxable Social Security benefits 950 7,650 $20,950 $52,650 Less: Exemption, standard deduction and additional standard deduction for the elderly for 2001 8,550 8,550 Taxable income $12,400 $44,100 Tax (per 2001 Tax Rate Schedule) $1,860 $8,832 Top tax rate 15% 28%

Careful planning could have avoided the stiff tax bill resulting from the IRA distribution. The withdrawal could have been spread out over more than one year. Another way to save in taxes is to liquidate assets other than an IRA account, such as stock showing only a small gain or stock whose gain can be offset by a capital loss on other shares. If you should need a large amount of cash for a specific purpose, please contact me before pulling money out of a retirement savings account so that the best method of raising the cash can be determined.

If you know your social security benefits will be taxed, you can voluntarily arrange to have the tax withheld from the payments by filing a Form W-4V. Otherwise, you may have to make estimated tax payments.

Please contact us if you’d like us to run some specific numbers for you, or if you would like to discuss this matter further.